Introduction

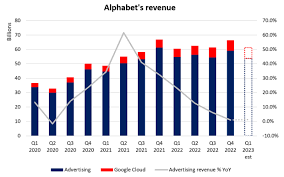

Alphabet, the parent company of Google, recently released its financial earnings report for the first quarter of 2023. This report provided valuable insights into the company’s performance, highlighting a modest overall revenue growth of 3%. However, Alphabet faced several challenges during this period, including slower search growth and a downturn in YouTube revenue. In this article, we will delve into the details of Alphabet’s Q1 2023 earnings, analyze the factors influencing its performance, and explore the company’s strategies for the future.

Slower Growth in Search & YouTube Revenue

Impact on Search Revenue

Alphabet’s search revenue experienced a modest 1.87% year-over-year increase in Q1 2023, which is significantly lower than the growth rates observed in previous quarters. In comparison, Q1 2022 witnessed a 24.28% jump, while Q1 2021 recorded a 30.11% increase. The company’s “search & other” revenues rose from approximately $39.6 billion to $40.4 billion, indicating potential difficulties in its primary business segment.

The slowdown in search growth can be attributed to several factors. Google Search faces intense competition from rivals such as Microsoft’s AI-powered Bing chatbot and OpenAI’s ChatGPT. These emerging technologies offer alternative ways for users to access information, posing a challenge to Google’s dominance in the search market. Additionally, the ongoing COVID-19 pandemic has impacted user behavior and search patterns, leading to fluctuations in search revenue.

Despite these challenges, Google executives remain optimistic about Search’s performance. Sundar Pichai, Alphabet’s CEO, stated that Search is “performing well,” while CFO Ruth Porat commended its “resilience” in the face of competitive pressures and economic uncertainties.

YouTube Ad Revenue Downturn

Alphabet also faced a downturn in YouTube ad revenue during Q1 2023. This decline can be attributed to reduced advertiser spending and the recent departure of CEO Susan Wojcicki. Advertisers may have adjusted their marketing strategies due to the ongoing economic uncertainty, leading to a decrease in ad investments on the platform.

While the decline in YouTube ad revenue is a concern, Alphabet remains committed to addressing this issue. The company continuously explores innovative ways to attract advertisers and enhance user engagement on the platform. YouTube is a valuable asset for Alphabet, and efforts to revitalize its ad revenue are expected to be a priority moving forward.

Alphabet’s Restructuring & AI Development

Restructuring Efforts

In pursuit of greater efficiency and advancement in artificial intelligence (AI), Alphabet has implemented significant restructuring efforts. The company made the decision to lay off approximately 12,000 employees in January, citing over-hiring during the pandemic as the reason behind the move. The Q1 2023 financial results include $2.6 billion in charges related to these workforce and office space reductions.

While restructuring can be disruptive, Alphabet aims to streamline its operations and optimize resource allocation. By eliminating redundancies and focusing on key areas of growth, the company seeks to enhance its overall performance and achieve long-term sustainability.

Emphasis on AI Development

Another crucial aspect of Alphabet’s strategy involves prioritizing AI development. In an increasingly competitive landscape, AI technologies play a vital role in maintaining a competitive edge. Alphabet aims to strengthen its AI capabilities to compete with emerging tools such as ChatGPT.

To bolster its AI portfolio, the company merged its previously separate AI teams under the new Google DeepMind group. This consolidation aims to foster collaboration and accelerate AI research and development. Alphabet’s commitment to AI innovation positions it well for future growth and positions it as a leader in the field.

Google Cloud Achieves Profitability

One positive highlight in Alphabet’s Q1 2023 earnings report is the profitability of its Google Cloud division. The cloud business reported quarterly profits of $191 million, marking a significant achievement for the company. This milestone reflects Alphabet’s success in leveraging its cloud infrastructure and services to generate sustainable revenue.

Google Cloud’s profitability is a testament to Alphabet’s commitment to diversifying its revenue streams and expanding its presence in the highly competitive cloud computing market. The division’s ability to deliver value to businesses and meet their evolving needs positions it for continued growth and success in the future.

Looking to the Future

As the I/O developer conference approaches in May, the tech industry eagerly awaits Google’s new developments and product announcements. Alphabet’s Q1 2023 earnings report provides a glimpse into the company’s performance amid substantial internal changes. Despite facing certain challenges, Alphabet remains dedicated to innovation, AI development, and future growth.

In conclusion, Alphabet’s Q1 2023 earnings report reveals both opportunities and challenges for the company. While slower search growth and a YouTube ad revenue downturn pose immediate concerns, Alphabet’s restructuring efforts, emphasis on AI development, and the profitability of Google Cloud demonstrate its resilience and commitment to long-term success. As Alphabet continues to navigate the evolving digital landscape, its ability to adapt, innovate, and deliver value will be crucial in driving future growth and maintaining its position as a leading technology company.

Additional Information:

- Alphabet’s Q1 2023 earnings report reflects the company’s performance from January to March 2023.

- The COVID-19 pandemic has had a significant impact on user behavior and search patterns, influencing Alphabet’s search revenue growth.

- Alphabet’s restructuring efforts aim to optimize resource allocation and streamline operations for increased efficiency.

- The consolidation of Alphabet’s AI teams under Google DeepMind enhances collaboration and accelerates AI research and development.

- Google Cloud’s profitability signifies Alphabet’s success in the highly competitive cloud computing market.

- Alphabet’s commitment to innovation, AI development, and future growth positions it well for continued success in the tech industry.

No comments! Be the first commenter?