Introduction For many, opening a checking account is a fundamental step in managing their finances. But does opening a checking account affect credit? This question often arises when individuals aim to safeguard or improve their credit scores. Understanding how financial accounts influence credit is essential for making informed decisions about your personal finances. In this..

How Much Does It Cost to Refinance Home Loan? A Comprehensive Guide

Introduction: What Does the Cost to Refinance Home Loan Really Mean? Refinancing a home loan is a financial strategy many homeowners consider when looking to lower their interest rates, reduce monthly payments, or access equity. However, before diving into the process, it’s crucial to understand the cost to refinance home loan. While refinancing may seem..

How to Get Preapproved for a VA Home Loan: A Comprehensive Guide

How to Get Preapproved for a VA Home Loan: A Comprehensive Guide If you're a veteran, active service member, or eligible surviving spouse, securing a VA home loan can be one of the most beneficial financial decisions you’ll make. VA loans offer favorable terms, such as no down payment, lower interest rates, and no private..

Exploring CIT Group Consumer Finance Inc: Empowering Financial Solutions for Consumers

Introduction In a rapidly evolving financial landscape, CIT Group Consumer Finance Inc. stands out as a key player in consumer finance, providing solutions that empower individuals to achieve their financial goals. With a focus on innovative services, CIT Group has successfully bridged the gap between consumers and comprehensive financial products, enhancing accessibility and convenience in..

Understanding CIT in Finance: Key Concepts and Applications

Introduction to CIT in Finance CITs in finance are specifically designed to pool assets from various sources, including 401(k) plans and pension funds, providing a robust alternative to mutual funds. Unlike mutual funds, CITs are primarily available to institutional investors, which allows them to benefit from a more tailored approach. With their growing popularity among..

Understand the benefits of Life Insurance for financial protection and peace of mind

Welcome to our guide on the benefits of life insurance. In today's uncertain world, financial protection and peace of mind are essential. Life insurance provides a safety net for your loved ones, ensuring they are taken care of financially in the event of your death. Life insurance offers several key benefits. Firstly, it can help..

Find your dream home as you Navigate the real estate market with expert guidance and resources

The real estate market can be overwhelming to navigate, but with the right guidance and resources, you can find your dream home with confidence. Whether you're a first-time homebuyer or an experienced investor, TheMLSonline is here to help you make informed decisions in the property market. With a vast array of property listings and experienced..

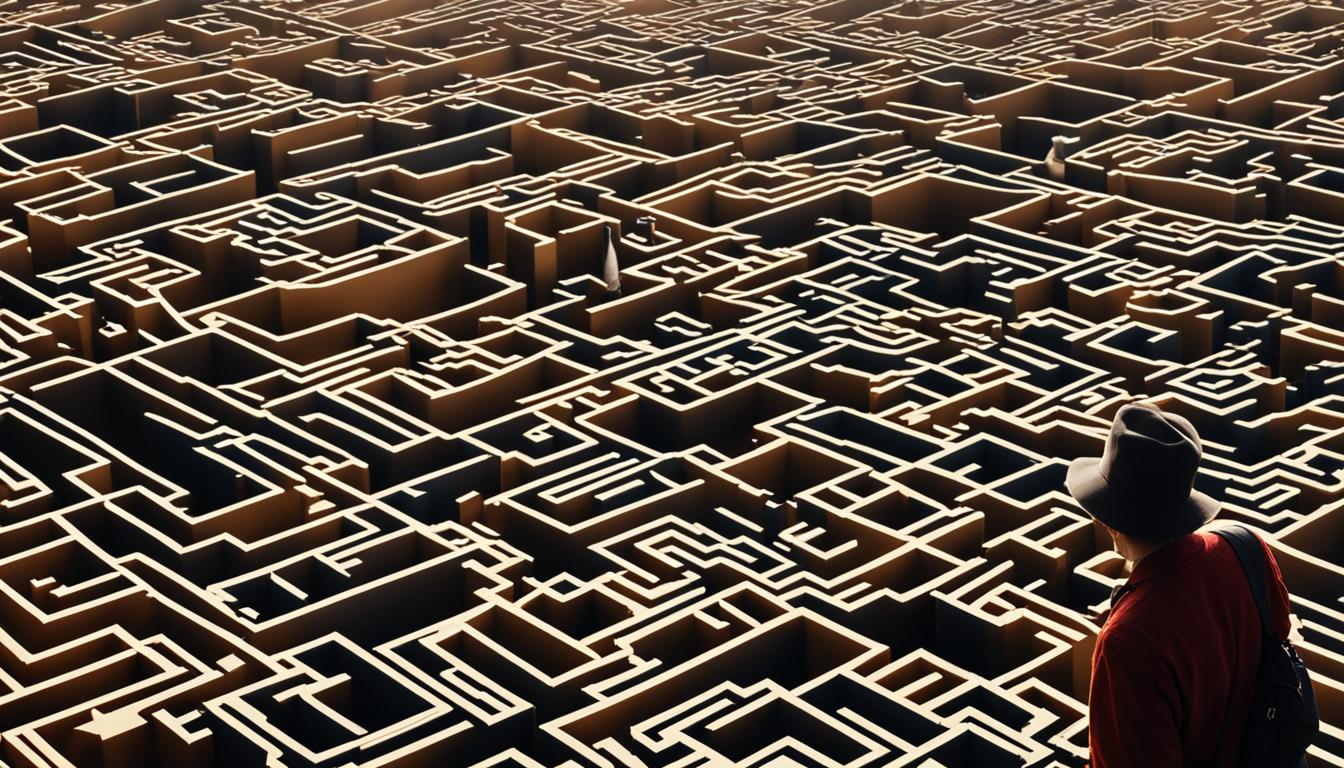

Journey Explore financial and investment opportunities for long term wealth growth

Are you ready to embark on a journey of financial success and long-term wealth growth? In today's ever-changing landscape, navigating the world of finance and investments can feel overwhelming. But fear not, because we're here to guide you through the process and help you uncover a world of opportunities. Financial planning and wealth management are..

Supporting Those Who Served with Discovering Veteran Nonprofit Organizations Nearby

Many veterans face challenges when transitioning to civilian life, including the loss of camaraderie and support they experienced in the military. Thankfully, there are numerous veteran nonprofit organizations located near you that provide vital assistance and support to veterans in need. Local charities for veterans play a crucial role in offering a sense of connection,..

Comprehensive Financial Insight to Understanding All 3 Credit Reports and Their Impact

When it comes to your financial well-being, understanding all 3 credit reports is essential. Equifax, TransUnion, and Experian are the three major credit bureaus in the U.S. Each of them generates their own credit report, which means you may have three different reports with your name. These reports provide a detailed breakdown of your credit..